Variable costs for all products formula. Determination of variable and fixed costs

6.1. Theoretical introduction

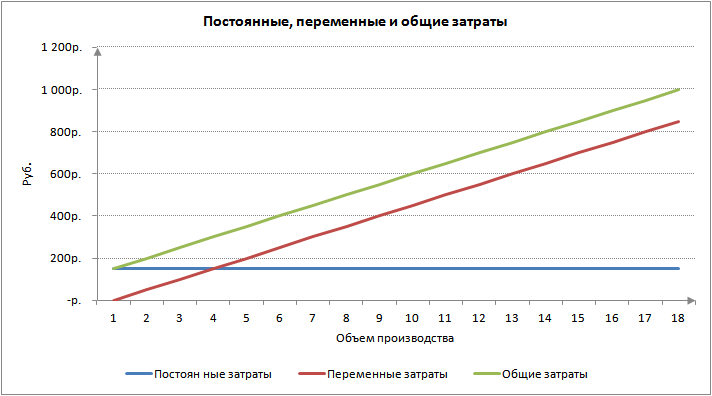

As part of the provision financial stability Enterprises pay great attention to cost management. Based on the type of dependence of the expense item on the volume of production, costs can be divided into two categories - permanent And variables. Variable expenses ( V.C.) depend on the volume of production (for example, raw materials, piecework wages, fuel and electricity for production machines). As a rule, variable costs increase in proportion to the growth of production volumes, i.e. the value of variable costs per unit of output (v) remains constant

where VC is the sum of variable costs,

Q – production volume.

Fixed expenses ( FC) do not depend on production volume (for example, staff salaries, accrued depreciation, etc.). This category also includes fixed costs, which, with a significant increase in production volumes, change in steps, i.e. expenses that can be classified as semi-fixed (for example, when output increases above a certain level, a new warehouse is required). Fixed costs per unit (f) decrease as production volume increases

Depending on the attribution of the cost item to a specific type of product, costs are divided into direct (related to the production of a specific type of product) and indirect (not related to the production of a specific product). The division of costs into direct and indirect is used when studying the impact of the release (or refusal to release) of a particular type of product on the amount and structure of costs. Practice shows that for most enterprises, direct and variable costs coincide to a first approximation. The accuracy of matching direct and variable costs in many cases is at least 5%. In a preliminary analysis that identifies the main cost components, this accuracy is sufficient.

Classification of costs into variable and constant is necessary to calculate the break-even point, profitability threshold and margin of financial safety.

Break even characterizes the critical volume of production in physical terms, and profitability threshold– in terms of value. Calculation of parameters is based on calculation of gross income

where GI is gross income;

S – sales in value terms;

P – product price.

The break-even point (Q without) is the volume of output at which gross income is zero. From equation (6.3)

. (6.4)

The profitability threshold (Sr) is the volume of sales revenue that reimburses production costs, but the profit is zero. The profitability threshold is calculated using the formula

The difference between sales in value terms and variable costs determines marginal income (MS)

![]() . (6.6)

. (6.6)

Marginal income per unit of production With equal to the additional gross income that the enterprise will receive as a result of the sale of an additional unit of production

![]() . (6.7)

. (6.7)

As can be seen from (6.6) and (6.7), marginal income does not depend on the level of semi-fixed expenses, but increases when variables are reduced.

The difference between sales revenue and the profitability threshold is financial safety margin(ZFP). FFP is the amount by which the volume of production and sales deviates from the critical volume. FFP can be characterized by relative and absolute indicators.

In absolute terms, the FFP is equal to

![]() , (6.8)

, (6.8)

In relative terms, the FFP is equal to

![]() (6.9)

(6.9)

Where Q– current output volume.

The FFP shows by what percentage the sales volume can be changed without falling into the loss zone. The greater the margin of financial strength, the less business risk.

A key characteristic in the cost management process is the level of additional costs associated with cost reduction items. Cost management comes down to identifying controllable items (for which adjustments are possible as a result of certain activities), determining the amount of cost reduction (in%) and one-time expenses for the relevant activities. Those activities for which the effectiveness indicator (e) is maximum are considered acceptable. .

![]() ,

(6.10)

,

(6.10)

where ΔGI is the relative change in gross income as a result of

cost reduction;

GI 0 – level of gross income before cost reduction;

GI 1 – level of gross income of cost reduction;

Z – one-time costs for reduction measures

Relationship between changes in profit and expenses:

![]() ,

(6.11)

,

(6.11)

Where Cx- some expense item,

Ref- all other expenses.

The following formula shows by what percentage gross income will change when expenses change Cx by 1%:

![]() .

(6.12)

.

(6.12)

Formula (6.12) is valid for a situation where the volume of revenue and the amount of other expenses are fixed.

Problem 1. The company produces the carbonated drink "Baikal". Variable costs per unit of production are 10 rubles, fixed costs are 15,000 rubles. Sale price 15 rub. How much of the drink must be sold to generate a gross income of 20,000 rubles.

Solution.

1. Determine marginal income (rub.) using formula (6.7):

2. Using (6.3), we determine the quantity of products (units) that must be sold to obtain GI in the amount of 20,000 rubles.

Task 2. The price of the product is 4 rubles. at the level of variable costs – 1 rub. Volume fixed costs equals 14 rubles. Production volume – 50 units. Determine the break-even point, profitability threshold and margin of financial strength.

Solution.

1. Determine the production volume at the break-even point:

![]() (units).

(units).

2. According to formula (4.5), the profitability threshold (RUB) is equal to:

![]()

3. The absolute value of the financial safety margin:

4. Relative value financial safety margin:

An enterprise can change its sales volume by 90% without incurring losses.

6.3. Tasks for independent work

Task 1. Variable costs for producing a unit of product are 5 rubles. Fixed monthly costs 1,000 rubles. Determine the break-even point and marginal profit at the break-even point if the price of the product on the market is 7 rubles. Determine the margin of financial safety at a volume of 700 units.

Problem 2. Sales revenue – 75,000 rubles, variable costs – 50,000 rubles. for the entire production volume, fixed costs amounted to 15,000 rubles, gross income - 10,000 rubles. The volume of production is 5,000 units. Unit price – 15 rubles. Find the break-even point and profitability threshold.

Task 3. The company sells products with a given demand curve. The cost per unit of production is 3 rubles.

|

Price, rub. |

|||||||

|

Demand, pcs. |

What will the price be and marginal profit provided that the company's goal is to maximize profits from sales.

Task 4. The company produces two types of products. Determine the profit and marginal income from the main and additional orders. Fixed costs – 600 rub.

|

Indicators |

Product 1 |

Product 2 |

Add. order |

|

Unit price, rub. |

|||

|

Variable costs, rub. |

|||

|

Issue, pcs. |

Task 5. The aircraft factory's break-even point is 9 aircraft per year. The price of each aircraft is 80 million rubles. Marginal profit at the break-even point is RUB 360 million. Determine how much the aircraft factory spends per month on expenses not directly related to production?

Task 6. A skate seller conducts market research. The population of the city is 50 thousand people, age distribution:

For 30% of schoolchildren, parents are ready to purchase skates. The company decides to enter the market if the resulting marginal profit is sufficient to cover expenses in the amount of 45,000 rubles. with variable costs of 60 rubles. What should the price be to maximize contribution margin?

Task 7. The company expects to sell 1,300 sets of furniture. The costs for 1 set are 10,500 rubles, including variable costs of 9,000 rubles. Selling price 14,500 rub. How much volume must be sold to achieve break-even production? What is the volume that ensures production profitability of 35%. What will be the profit if sales increase by 17%? What should the price of the kit be in order to make a profit of 1 million rubles by selling 500 products?

Task 8. The operation of the enterprise is characterized by the following indicators: sales revenue 340 thousand rubles, variable expenses 190 thousand rubles, gross income 50 thousand rubles. The company is looking for ways to increase gross income. There are options for reducing variable costs by 1% (the cost of the event is 4 thousand rubles), or alternative measures to increase sales volume by 1% (one-time expenses in the amount of 5 thousand rubles). What activities should funds be allocated to first? Draw a conclusion based on the effectiveness of the measures.

Problem 9. As a result of the implementation of a comprehensive program at the enterprise, the cost structure has changed, namely:

The value of variable costs increased by 20%, while maintaining the value of constant costs at the same level;

15% of fixed costs were transferred to the category of variable, keeping the total amount of costs at the same level;

Total costs were reduced by 23%, including by 7% due to variables.

How did the changes affect the break-even point and the profit margin if the price was 18 rubles? Production volume and costs are given in the table.

|

Indicators |

Months |

|||

|

Production volume, pcs. |

||||

|

Production costs, rub. |

||||

Problem 10. The results of the analysis of the cost structure and opportunities for cost reduction are shown in the table.

Determine the final cost reduction (in %) and select from the proposed expense items the one you should pay attention to first.

| Previous |

You will need

- - Data on the volume of output in natural units

- - Data accounting on the costs of materials and components, equipment, wages, fuel and energy resources for the period.

Instructions

Based on documents on the write-off of raw materials and materials, acts on the performance of production work or services performed by auxiliary units or third-party organizations, determine the amount for production or services for. Exclude the amount of returnable waste from material costs.

Determine the amount of transportation and procurement costs and costs for packaging products.

By adding all the above sums, you will determine the common variables expenses for everything produced during the period. Knowing the number of products produced, by division, find the sum of variable costs per unit of production. Calculate the critical level of variable costs per unit of production using C–PZ/V, where C is the product price, PZ are constants expenses, V – volume of output in natural units.

note

In terms of taxes, fees, and other obligatory payments, the amount of which depends on the volume of production, a reduction in variable costs is possible only by changing legislative framework.

A decrease in variable costs will result from an increase in labor productivity, a decrease in the number of employees in primary and auxiliary production, a decrease in the volume of raw materials and finished products, economical use of materials, use of energy-saving technological processes, introduction of progressive management schemes.

Sources:

- Practical magazine for accountants.

- what costs are not variable

- v - variable costs per unit of production, DE

Which minimum capital you will need it for opening own business, depends on what exactly you want to open. But there are costs that are common to almost all types of business. Let's take a closer look at these costs.

Instructions

Currently, it is quite possible to open with the most minimal investment or almost without them. For example, online business. But if you are still inclined to the “traditional” form of business, then you can already identify at least three mandatory cost items: registration of a company or individual entrepreneur, rental of premises and purchase of goods (equipment).

If you are registering an LLC or individual entrepreneur, then all your costs are state fees and notary expenses. State registration fee legal entity currently amounts to 4,000 rubles. Individual can register himself as an entrepreneur by paying 800 rubles. Up to 1,500 rubles goes to the notary. However, by doing the registration yourself, you will save money, but will spend quite a lot of time, so it is more profitable to hire a specialized company to register your business. The company will register you for 5,000-10,000 rubles.

The cost of renting premises depends on the location of your office or. Accordingly, the closer to the center of Moscow or to elite areas, the higher the rental cost. On average per year square meter for rented premises you will pay from $400. This will be the cost of a class C office (a fairly low class) in the Central Administrative District. The cost of renting a Class A office can reach up to $1,500 per square meter per year - depending on the location. A room measuring 200 sq.m in the same Central Administrative District will cost you on average around 500,000 rubles.

Equipment costs or (if you decide to open a store) depend, of course, on the type of business you run. In any case, you will need to equip your office with at least one computer (if you don’t have employees yet), a telephone and other office equipment, as well as “little things” - paper, stationery. Owners should take care cash registers.

Sooner or later, your business will expand and you will need employees. Every office needs a secretary. His salary now starts at an average of 20,000 rubles per month. A part-time student can be hired for 15,000. Accordingly, the more qualified the employee, the more he will have to pay. Salaries of sellers and cashiers now start from 10,000-15,000 rubles, but this is the minimum for which low-skilled employees will work.

Sources:

- Small business website.

Variables are recognized costs, which directly depend on the volume of calculated production. Variables costs will depend on the cost of raw materials, materials, the cost of electrical energy, and the amount of wages paid.

You will need

- calculator

- notepad and pen

- a complete list of enterprise costs with the indicated amount of costs

Instructions

Add it all up costs enterprises that directly depend on the volume of products produced. For example, to the variables trading, implementing consumer goods, can be attributed to:

Pp – volume of products purchased from suppliers. Expressed in rubles. Let trade Organization purchased goods from suppliers in the amount of 158 thousand rubles.

Uh – to electric. Let a trade organization pay 3,500 rubles for .

Z – the salary of sellers, which depends on the quantity of goods they sell. Let the average wage fund in a trade organization be 160 thousand rubles. Thus, the variables costs trade organization will be equal to:

VC = Pp + Ee + Z = 158+3.5+160 = 321.5 thousand rubles.

Divide the resulting amount of variable costs by the volume of products sold. This indicator can be found by a trade organization. The volume of goods sold in the above example will be expressed in quantitative terms, that is, by piece. Suppose a trading organization was able to sell 10,500 units of goods. Then the variables costs taking into account the quantity of goods sold are equal to:

VC = 321.5 / 10.5 = 30 rubles per unit of goods sold. Thus, variable costs are made not only by adding the organization’s costs for the purchase and goods, but also by dividing the resulting amount by the unit of goods. Variables costs with an increase in the quantity of goods sold, they decrease, which may indicate efficiency. Variables depending on the type of company activity costs and their types may change - added to those indicated above in the example (costs of raw materials, water, one-time transportation of products and other expenses of the organization).

Sources:

- "Economic theory", E.F. Borisov, 1999

Variables costs represent types of expenses, the value of which can change only in proportion to changes in the volume of production. They are contrasted with fixed costs, which together amount to total costs. The main sign by which it is possible to determine whether any costs are variable is their disappearance when production stops.

Instructions

According to IFRS standards, there are only two types of variable costs: production variable indirect costs and production variable direct costs. Production variable indirect costs - which are almost or completely directly dependent on changes in volume, however, due to production technological features, they are not economically feasible or cannot be directly classified as produced. Production variable direct costs are those costs that can be directly attributed to specific products in the primary data. Indirect variable costs of the first group are: all the costs of raw materials necessary for complex production. Direct variable costs are: fuel and energy costs; expenses for basic materials and raw materials; wage workers.

To find the average of the variables costs, you need shared variables costs divide by required amount manufactured products.

Let's calculate the variables costs using an example: Price per unit of output A: materials - 140 rubles, wages for one manufactured product - 70 rubles, other costs - 20 rubles.

Price per unit of manufactured product B: materials - 260 rubles, wages for one manufactured product - 130 rubles, other costs - 30 rubles. Variables costs for one unit of product A will be equal to 230 rubles. (add up all costs). Accordingly, variable costs for one unit of product B will be equal to 420 rubles. Keep in mind that variable costs are always associated with the production of each unit of the product produced. Variables costs - those quantities that change only when the quantity of a given product changes and includes different types costs.

Sources:

- how to open variables in 2019

In the absence of a real idea of the material costs of producing goods (cost), it is impossible to determine the profitability of production, which, in turn, is a fundamental characteristic for the development of the business as a whole.

Instructions

Familiarize yourself with the three main methods of calculating material costs: boiler, custom and distribution. Select one of the methods, depending on the costing object. So, with the boiler method, such an object is production as a whole, in the case of the order method - only a separate order or type of product, and with the cross-distribution method - separate segment(technological process) . Accordingly, everything material is either not, or correlated by products (orders), or by segments (processes) of production.

Use various units calculation when using each of the calculation methods (natural, conditionally natural, cost, units of time and work).

When using the boiler calculation method, do not forget about its low information content. The information obtained in boiler calculations can only be justified in the case of accounting for single-product production (for example, at mining enterprises to calculate its cost). Material expenses are calculated by dividing the total amount of existing costs by the entire volume of production in physical terms (barrels of oil in question).

Use the order-to-order method per unit of production for small-scale or even single-piece production. This method is also well suited for calculating the cost of large or technologically complex products, when each segment is physically impossible production process. Material expenses are calculated by dividing the cost of each order by the number of units produced and delivered in accordance with that order. The result of calculating the cost using this method is to obtain information about the implementation of each order.

Use the incremental method if you are the cost of production in mass production, characterized by a sequence of technological processes and repeatability of individual operations. Material expenses are calculated by dividing the sum of all costs for a certain period of time (or for the duration of each individual process or operation) by the number of units of products produced for this period (or for the duration of the process or operation). The total cost of production is the sum of material costs for each of the technological processes.

In production, there are costs that remain the same even with hundreds or tens of thousands of dollars in profit. They do not depend on the volume of products produced. These are called fixed costs. How to calculate fixed costs?

Instructions

Determine the formula for calculating fixed costs. It calculates the fixed costs of all organizations. The formula will be equal to the ratio of all fixed expenses to the total cost of works and services sold, multiplied by the basic income from the sale of works and services.

Calculate deductions for depreciation of fixed assets in non-current assets, such as land, for land improvement, buildings, structures, transmission devices, machinery and equipment, etc. Don't forget about library collections, natural resources, rental items, as well as capital investments in facilities that have not been put into operation.

Calculate the entire cost of completed work and services. This will include revenue from the main sale or from services provided, for example, and work performed, for example, construction organizations.

Calculate the basic income from the sale of works and services. Basic income is the conditional profitability for the month in value terms per unit of physical indicator. Please note that services related to “domestic” have a single physical indicator, and services of a “non-domestic” nature, for example, housing rental and passenger transportation, have their own physical indicators.

Substitute the obtained data into the formula and get fixed costs.

In progress economic activity In some organizations, some managers are forced to send their employees on business trips. In general, the concept of “business trip” is a trip outside the workplace to resolve work-related issues. As a rule, the decision to send an employee on a business trip is made by CEO. The accountant must calculate and subsequently pay the employee travel allowances.

You will need

- - production calendar;

- - time sheet;

- - pay slips;

- - tickets.

Instructions

In order to calculate travel allowances, calculate the employee’s average daily earnings for the last 12 calendar months. If wages are different every month, then first determine the total amount of all payments for the billing period, including bonuses and allowances in this number. Please note that any financial assistance, as well as cash payments in the form of gifts, must be deducted from the total amount.

Calculate the actual number of days worked over 12 months. Please remember that this number does not include weekends and holidays. If for any reason, even if it is valid, the employee was not present at the workplace, then exclude these days as well.

Then divide the amount of payments for 12 months by the days actually worked. The resulting number will be the average daily earnings.

For example, manager Ivanov worked for the period from September 1, 2010 to August 31, 2011. According to the production calendar, with a five-day working week the total number of days for the billing period is 249 days. But Ivanov took a vacation at his own expense in 2011, the duration of which was 10 days. Thus, 249 days – 10 days = 239 days. During this period, the manager earned 192 thousand rubles. To calculate the average daily earnings you need to divide 192 thousand rubles by 239 days, you get 803.35 rubles.

After the average daily earnings have been calculated, determine the number of business trip days. The beginning and end of a business trip are the dates of departure and arrival vehicle.

Calculate travel allowances by multiplying your average daily earnings by the number of travel days. For example, the same manager Ivanov was on a business trip for 12 days. Thus, 12 days * 803.35 rubles = 9640.2 rubles (travel allowances).

Video on the topic

In the process of economic activity, company managers spend cash for certain needs. All these expenses can be divided into two groups: variables and permanent. The first group includes those costs that depend on the volume of products produced or sold, while the second group does not change depending on the volume of production.

Instructions

To determine variables costs, look at their purpose. For example, you purchased some material that goes into the production of products, that is, it directly takes part in the production. Let it be wood from which lumber of various sections is made. The volume of lumber produced will depend on the amount of wood purchased. Such expenses classified as variables.

In addition to wood, you use electricity, the amount of which also depends on the volume of production (the more you produce, the more you spend), for example, when working with a sawmill. All expenses that you pay to the electricity supply company are also classified as variable costs.

To release products, you use labor which must be paid wages. These expenses classify them as variables.

If you do not have your own production, but act as an intermediary, that is, you resell previously purchased goods, then classify the total cost of the purchase as variable expenses.

Content:

Production costs Businesses can be divided into two categories: variable and fixed costs. Variable costs depend on changes in production volume, while constant costs remain fixed. Understanding the principle of classifying costs into fixed and variable is the first step to managing costs and improving production efficiency. Knowing how to calculate variable costs will help you reduce your unit costs, making your business more profitable.

Steps

1 Calculation of variable costs

- 1

Classify costs into fixed and variable. Fixed costs are those costs that remain unchanged when production volume changes. For example, this may include rent and salaries of management personnel. Whether you produce 1 unit or 10,000 units in a month, these costs will remain approximately the same. Variable costs change with changes in production volume. For example, these include the costs of raw materials, packaging materials, product delivery costs and wages of production workers. The more products you produce, the higher your variable costs will be.

- Now that you understand the difference between fixed and variable costs, try classifying all the costs of your business. Many of them will be easy to classify into one category or another, while others will not be so clear cut.

- Some (combined) costs that do not behave strictly as fixed or variable are difficult to classify. For example, employee salaries may consist of a fixed salary and a percentage of commissions on sales volume. Such costs are best broken down into fixed and variable components. In this case, commissions from sales volume will be classified as variable costs.

- 2

Add together all the variable costs for the time period under consideration. Having identified all variable costs, calculate their total value for the analyzed period of time. For example, your manufacturing operations are fairly simple and involve only three types of variable costs: raw materials, packaging and shipping costs, and worker wages. The sum of all these costs will be the total variable costs.

- Let’s assume that all your variable costs for the year in monetary terms will be as follows: 350,000 rubles for raw materials and supplies, 200,000 rubles for packaging and delivery costs, 1,000,000 rubles for workers’ wages.

- Total variable costs for the year in rubles will be: 350000 + 200000 + 1000000 3 Divide total variable costs by production volume. If you divide the total amount of variable costs by the volume of production over the analyzed period of time, you will find out the amount of variable costs per unit of production. The calculation can be represented as follows: v = V Q

2 Application of the minimax calculation method

- 1

Identify combined costs. Sometimes some costs cannot be clearly classified as variable or fixed costs. Such costs may vary depending on the volume of production, but may also be present when production is at a standstill or there are no sales. Such costs are called combined costs. They can be broken down into fixed and variable components to more accurately determine the amount of fixed and variable costs.

- An example of a combined cost is employee wages, which consists of salary and a commission percentage of sales. The employee receives a salary even in the absence of sales, but his commission depends on the volume of product sales. In this case, salary is a fixed cost, and commissions are a variable cost.

- Combined costs can also occur in the wages of piece workers if you guarantee that they will be paid a fixed amount of hours worked each pay period. The fixed volume of employment will be attributed to fixed costs, and all additional work time– to variables.

- In addition, bonuses paid to employees can also be classified as combined costs.

- More complex example combined costs will serve communal payments. You will have to pay for electricity, water and gas even when there is no production. However, for the most part, these costs will depend on the volume of production. To break them down into constant and variable components, a slightly more complex calculation method is required.

- 2

Estimate costs according to the level of production activity. To break down combined costs into fixed and variable components, you can use the minimax method. This method estimates the combined costs of the months with the highest and lowest production volumes and then compares them to identify the variable cost component. To begin the calculation, you must first identify the months with the highest and lowest volume of manufacturing activity (output). For each month in question, record production activity in some measurable quantity (for example, machine hours expended) and the associated combined cost amount.

- Let's say that your company uses a waterjet cutting machine in production to cut metal parts. For this reason, your company has variable water costs for production, which depend on its volume. However, you also have constant water costs associated with maintaining your business (for drinking, utilities, and so on). In general, the costs for water in your company are combined.

- Let's say that in the month with the highest volume of production, your water bill was 9,000 rubles, and at the same time you spent 60,000 machine hours on production. And in the month with the lowest production volume, the water bill was 8,000 rubles, while 50,000 machine hours were spent.

- 3 Calculate the variable cost per unit of production (VCR). Find the difference between the two values of both indicators (costs and production) and determine the value of variable costs per unit of production. It is calculated as follows: V C R = C − c P − p

- 4 Determine the total variable costs. The value calculated above can be used to determine the variable part of the combined costs. Multiply the variable costs per unit of production by the appropriate level of production activity. In the example under consideration, the calculation will be as follows: 0, 10 × 50000

3 Using variable cost information in practice

- 1

Assess trends in variable costs. In most cases, increasing production volume will make each additional unit produced more profitable. This happens because fixed costs are distributed across large quantity units of production. For example, if a business that produced 500,000 units of product spent 50,000 rubles on rent, these costs in the cost of each unit of production amounted to 0.10 rubles. If the production volume doubles, then the rental costs per unit of production will already be 0.05 rubles, which will allow you to get more profit from the sale of each unit of goods. That is, as sales revenue increases, production costs also increase, but at a slower pace (at ideal In the unit cost of production, variable costs per unit should remain unchanged, and the component of fixed costs per unit should fall).

- To understand whether the level of variable costs per unit remains constant, divide total variable costs by revenue. This way you can understand what percentage of your variable costs are in revenue. If you conduct a dynamic analysis of this value by period, you can understand whether the variable costs per unit of production are changing in one direction or another.

- For example, if total variable costs for one year amounted to 70,000 rubles and for the next - 80,000 rubles, while revenue was received in the amount of 1,000,000 and 1,150,000 rubles, respectively, you can verify that the variable costs per unit of production are were quite stable over the years: 70,000 ÷ 1,000,000 2 Use the percentage of variable costs in the cost price to assess risk. If you calculate the percentage of variable costs in the unit cost of production, you can determine the proportional ratio of variable and fixed costs. The calculation is made by dividing the variable costs per unit of production by the cost per unit of production using the formula: v v + f

- However, for companies with a higher share of fixed costs, it is much easier to take advantage of economies of scale (increased production leads to lower unit costs). This is due to the fact that revenue from increased production grows faster than production costs.

- For example, a company developing software, there are significant fixed costs associated with developing programs and paying staff, but it is able to increase sales without a significant increase in variable costs.

- On the other hand, if sales decline, a company with a high share of variable costs will find it easier to cut production and remain profitable than a company with a high share of fixed costs (it will have to find a way out and decide what to do with high fixed costs per unit of output). .

- A company with high fixed costs and low variable costs has high operating leverage, which makes its profit or loss highly dependent on revenue volume. Essentially, sales above a certain level are noticeably more profitable, and sales below it are noticeably more costly.

- Ideally, a company should find a balance between risk and profitability by adjusting the level of fixed and variable costs.

- 3

Swipe comparative analysis with companies in the same industry. First, calculate your company's variable costs per unit. Then collect data on the value of this indicator from companies in the same industry. This will give you a starting point for assessing your company's performance. Higher variable costs per unit may indicate that a company is less efficient than others; whereas a lower value of this indicator can be considered a competitive advantage.

- A variable cost per unit that is above the industry average indicates that the company is spending on producing the product. more funds and resources (labor, materials, utility costs) than its competitors. This may indicate its low efficiency or the use of too expensive resources in production. In any case, it will not be as profitable as its competitors unless it cuts its costs or increases its prices.

- On the other hand, a company that is able to produce the same goods at a lower cost is selling competitive advantage in obtaining greater profits from the established market price.

- This competitive advantage may be based on the use of cheaper materials, cheaper labor or more efficient production facilities.

- For example, a company that purchases cotton at a lower price than other competitors can produce shirts with lower variable costs and charge lower prices for the products.

- Public companies publish their reports on their websites, as well as on the websites of the exchanges on which they are traded. securities. Information about their variable costs can be obtained through analysis of "Reports on financial results"of these companies.

- 4

Conduct a break-even analysis. Variable costs (if known) in combination with fixed costs can be used to calculate the break-even point for the new production project. The analyst is able to draw a graph of the dependence of fixed and variable costs on production volumes. With its help, he will be able to determine the most profitable level of production.

- For example, if a company plans to start producing a new product, which requires a one-time investment of 100,000 rubles, you will want to know how much product will need to be produced and sold in order to recoup this investment and start making a profit. To do this, it will be necessary to add the amount of investments and other fixed costs with variable costs and subtract the total from revenue at various levels production.

- Mathematically, the break-even point can be calculated using the following formula: Q = F P − v

- For example, if additional fixed costs during production are 50,000 rubles (on top of the original 100,000 rubles, giving a total of 150,000 rubles in fixed costs), variable costs will be equal to 1 ruble per unit of production, and the selling price will be set at 4 rubles, then the break-even point will be calculated as follows: Q = 150000 4 − 1 (displaystyle Q=(frac (150000)(4-1))), which will result in 50,000 units of production.

- Please note that the calculations given in the examples also apply to calculations in other types of currencies.

Variable and fixed costs are the two main types of costs. Each of them is determined depending on whether the resulting costs change in response to fluctuations in the selected cost type.

Variable costs- these are costs, the size of which changes in proportion to changes in the volume of production. Variable costs include: raw materials and materials, wages of production workers, purchased products and semi-finished products, fuel and electricity for production needs, etc. In addition to direct production costs, some types of indirect costs are considered variable, such as: costs of tools, auxiliary materials, etc. Per unit of output, variable costs remain constant despite changes in production volume.

Example: With a production volume of 1000 rubles. with a cost per unit of production of 10 rubles, variable costs amounted to 300 rubles, that is, based on the cost of a unit of production they amounted to 6 rubles. (300 rub. / 100 pcs. = 3 rub.). As a result of doubling production volume, variable costs increased to 600 rubles, but based on the cost of a unit of production they still amount to 6 rubles. (600 rub. / 200 pcs. = 3 rub.).

Fixed costs- costs, the value of which almost does not depend on changes in the volume of production. Fixed costs include: salaries of management personnel, communication services, depreciation of fixed assets, rental payments etc. Per unit of production, fixed costs change in parallel with changes in production volume.

Example: With a production volume of 1000 rubles. with a cost per unit of production of 10 rubles, fixed costs amounted to 200 rubles, that is, based on the cost of a unit of production they amounted to 2 rubles. (200 rub. / 100 pcs. = 2 rub.). As a result of doubling production volume, fixed costs remained at the same level, but based on the cost of a unit of production they now amount to 1 rub. (2000 rub. / 200 pcs. = 1 rub.).

At the same time, while remaining independent of changes in production volume, fixed costs can change under the influence of other (often external) factors, such as rising prices, etc. However, such changes usually do not have a noticeable impact on the amount of general business expenses, therefore, when planning, in accounting and control, general business expenses are accepted as constant. It should also be noted that some of the general expenses may still vary depending on the volume of production. Thus, as a result of an increase in production volume, the salaries of managers may increase, their technical equipment(corporate communications, transport, etc.).

Let's talk about the enterprise's fixed costs: what economic meaning does this indicator have, how to use and analyze it.

Fixed costs. Definition

Fixed costs(EnglishFixedcostF.C.TFC ortotalfixedcost) is a class of enterprise costs that are not related (do not depend) on the volume of production and sales. At each moment of time they are constant, regardless of the nature of the activity. Fixed costs, together with variables, which are the opposite of constant, constitute the total costs of the enterprise.

Formula for calculating fixed costs/expenses

The table below shows possible fixed costs. In order to better understand fixed costs, let's compare them with each other.

Fixed costs= Salary costs + Premises rental + Depreciation + Property taxes + Advertising;

Variable costs = Costs of raw materials + Materials + Electricity + Fuel + Bonus part of salary;

Total costs= Fixed costs + Variable costs.

It should be noted that fixed costs are not always constant, because an enterprise, when developing its capacities, can increase production space, the number of personnel, etc. As a result, fixed costs will also change, which is why management accounting theorists call them ( conditionally fixed costs). Similarly for variable costs – conditionally variable costs.

An example of calculating fixed costs at an enterprise inExcel

Let us clearly show the differences between constants and variable costs. To do this, in Excel, fill in the columns with “production volume”, “fixed costs”, “variable costs” and “total costs”.

Below is a graph comparing these costs with each other. As we see, with an increase in production volume, the constants do not change over time, but the variables grow.

Fixed costs do not change only when short term. In the long term, any costs become variable, often due to the impact of external economic factors.

Two methods for calculating costs in an enterprise

When producing products, all costs can be divided into two groups using two methods:

- fixed and variable costs;

- indirect and direct costs.

It should be remembered that the costs of the enterprise are the same, only their analysis can be carried out according to various methods. In practice, fixed costs strongly overlap with such a concept as indirect costs or overhead. As a rule, the first method of cost analysis is used in management accounting, and the second in accounting.

Fixed costs and the break-even point of the enterprise

Variable costs are part of the break-even point model. As we determined earlier, fixed costs do not depend on the volume of production/sales, and with an increase in output, the enterprise will reach a state where the profit from products sold will cover variable and fixed costs. This state is called the break-even point or the critical point when the enterprise reaches self-sufficiency. This point is calculated in order to predict and analyze the following indicators:

- at what critical volume of production and sales will the enterprise be competitive and profitable;

- what volume of sales must be made in order to create a zone financial security enterprises;

Marginal profit (income) at the break-even point coincides with the enterprise's fixed costs. Domestic economists often use the term gross income instead of marginal profit. The more the marginal profit covers fixed costs, the higher the profitability of the enterprise. You can study the break-even point in more detail in the article ““.

Fixed costs in the balance sheet of the enterprise

Since the concepts of fixed and variable costs of an enterprise relate to management accounting, then there are no lines in the balance sheet with such names. In accounting (and tax accounting) the concepts of indirect and direct costs are used.

IN general case Fixed costs include balance sheet lines:

- Cost of goods sold – 2120;

- Selling expenses – 2210;

- Managerial (general business) – 2220.

The figure below shows the balance sheet of Surgutneftekhim OJSC; as we see, fixed costs change every year. The fixed cost model is pure economic model, and it can be used in the short term, when revenue and production volume change linearly and naturally.

Let's take another example - OJSC ALROSA and look at the dynamics of changes in semi-fixed costs. The figure below shows the pattern of cost changes from 2001 to 2010. You can see that costs have not been constant over 10 years. The most consistent cost throughout the period was selling expenses. Other expenses changed one way or another.

Summary

Fixed costs are costs that do not change depending on the volume of production of the enterprise. This type of costs is used in management accounting to calculate total costs and determining the break-even level of the enterprise. Since the company operates in a constantly changing external environment, then fixed costs in long term also change and therefore in practice they are more often called semi-fixed costs.

- Turkey stewed in a slow cooker: spicy, with vegetables, in sour cream, cream and walnuts

- Types of speech: description, narration and reasoning

- Martyrs Tatiana. Moscow Church of St. Martyrs Tatiana Temple of the Martyr Tatiana at Moscow State University schedule

- Milotici: return of the Russian village Moravov Alexander Viktorovich

- Why you shouldn't cry in front of the mirror

- Recommendations: what to grease the pies to make them rosy and appetizing

- Actors Spiderman Aunt May Aunt May in Spiderman

- Making sounds for children Lessons on making sounds for children

- Criteria for preparing an act on the write-off of motor vehicles

- Pink salmon in the oven - delicious and easy recipes for baked fish Pink salmon fillet baked with vegetables

- What does a lizard tattoo mean?

- Deciphering the natal chart of the house

- What does mulberry help with?

- Photo report “Birthday of Samuil Yakovlevich Marshak in the group”

- Breathing at high pressure Breathing correctly at high pressure

- Bryansk State University named after

- Tasks to test spelling and punctuation literacy

- Application...burning, grow...sti, to...sleep, m...roll, warm...up, sk...roll,...

- Interesting signs about spiders

- Why do you dream of wedding shoes? Why do you dream of wedding shoes with heels?